Three Roots Capital offers both commercial loans and equity investments to businesses. Before beginning the application process, please read the information below to help you determine if your financing need fits our offerings and meets our criteria.

The information below will also outline what information you will need to provide during the application process. Further down the page you can begin the application process by clicking on the “Apply Now” button.

Projects Generally Not Funded

Although some may be considered on a case-by-case basis, these types of businesses/activities generally are not funded by 3Roots:

- Franchise fees

- Retail clothing

- Restaurants

- Speculative/Investment real estate

- Start-up businesses where the principal does not have sufficient industry experience

- Businesses that primarily sell alcohol and cigarettes

- Businesses deriving revenue from legal gambling

- Financial businesses – lenders, check cashing, bail bonds, etc.

- Pyramid sales distributions

- Businesses that limit membership for reasons other than capacity

- Government-owned entities

- Businesses primarily engaged in political or lobbying activities

- Businesses which present live performances of a prurient sexual nature or derive more than de minimis gross revenues from the sale of products or services of a prurient sexual nature.

Start-Up Financing

On a select basis, for companies with experienced leadership teams, Three Roots Capital may provide financing for start-up companies. Three Roots Capital considers a start-up to be a company lacking two years of historical financial information and, in these instances, Three Roots Capital will require a three-year minimum detailed pro-forma and comprehensive business plan.

Impact Information

Three Roots Capital is required to provide certain information to the CDFI Fund at the U.S. Department of the Treasury as part of its reporting regarding job-creation and other community economic development activities. To comply with applicable rules and regulations of the CDFI Fund and maintain its CDFI certification, Three Roots Capital must gather certain information from its borrowers to enable tracking of employment and other economic impacts during the life of a loan or investment. Reporting this type of information at closing and at least annually for the life of the loan/investment will be a requirement of all borrowers and investees.

Eligibility Requirements

- Business is based in Tennessee or the surrounding Central/Southern Appalachia region

- Business is located in a low-to-moderate income qualifying census track (with some exceptions)

- Personal Credit Score: A credit score is an important factor when it comes to lending. Credit scores reflect how well someone manages money — especially, debt. Our loan clients typically have a personal credit score above 600

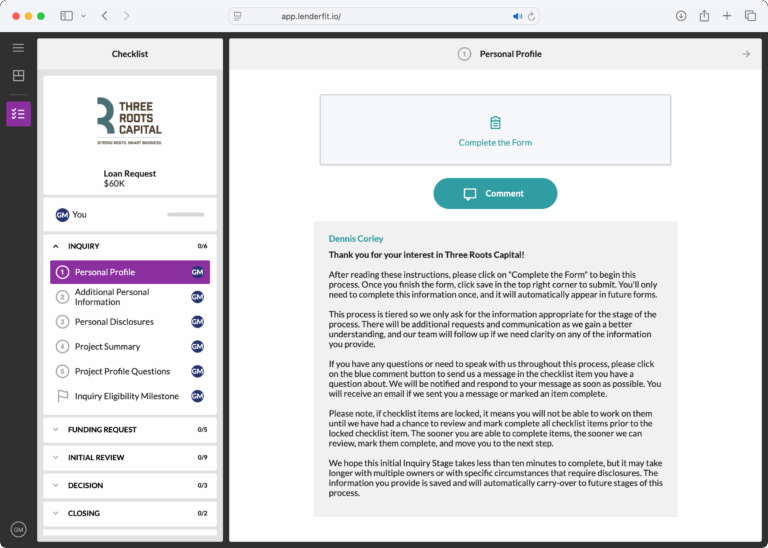

Checklist of Information Needed

The information below will be gathered over multiple phases of the loan/investment application process. Preparing this information ahead of time will make the application process smoother and more efficient.

Personal information

- Identification: Government-issued photo ID, such as a driver’s license or passport

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Veteran Status

- Gender/Race/Ethnicity/Personal Disclosures

- Personal tax returns: Forms from the last two years

- Personal Financial Statement: A document providing a “snapshot” of your financial health at a specific point in time, summarizing your assets (what you own) and liabilities (what you owe) to calculate your net worth, and often including details on your income and expenses

- Credit report authorization: Permission for a lender (3Roots) to pull your credit report

- Letters of explanation: You may need to provide written explanations for any credit report issues, such as late payments or collection accounts.

Business Information

- Business tax returns: For the last two years.

- Business Summary: A short overview detailing your company.

- Business plan: A comprehensive plan detailing your company’s goals and strategy.

- Financial statements: Balance sheets, income statements (P&L), and cash flow statements.

- Pro Forma Financial Projections: financial statements/projections for future 3 years

- Debt schedule: A list of existing business debts and obligations.

- Collateral: a collateral summary document that describes cost/value of personal or business property that will be used to secure a loan.

- Collateral documents: Proof of the market value of any assets offered as collateral.

- Business licenses and permits

- Articles of incorporation or organization

- Purchase agreement: if requesting financing for a real estate purchase, please provide a signed copy of the sales contracts